Мобильные платежи

With the departure of the UK from the EU it was expected that at some point, the EU and the UK regulatory regimes will start diverging. With Regulation 2024/791 amending MiFIR, the EU has introduced new asset classes which are now captured by the MiFIR reporting obligation https://divandi.ru/tests/pgs/chto-takoie-ts-upis-i-zachiem-on-nuzhien-ighrokam-bietsiti.html. The amended rules came into effect on the 28th of March 2024. The new instruments captured under EU-MiFIR are not, currently, subject to the UK’s MiFIR reporting obligation.

**Trials are provided to all LexisNexis content, excluding Practice Compliance, Practice Management and Risk and Compliance, subscription packages are tailored to your specific needs. To discuss trialling these LexisNexis services please email customer service via our online form. Free trials are only available to individuals based in the UK, Ireland and selected UK overseas territories and Caribbean countries. We may terminate this trial at any time or decide not to give a trial, for any reason. Trial includes one question to LexisAsk during the length of the trial.

This dataset is used to validate and enrich the transaction reports received under RTS 22. FCA FIRDS helps firms, amongst other things, to determine their transaction reporting obligations. This system enables firms to download full and delta reference files.

Other clarifications include the classification of financial assets with ESG linked features via additional guidance on the assessment of contingent features. Clarifications have been made to non-recourse loans and contractually linked instruments.

With the amendments, the IASB has also introduced additional disclosure requirements with regard to investments in equity instruments measured at fair value through other comprehensive income and financial instruments with contingent features (e.g. ESG objectives).

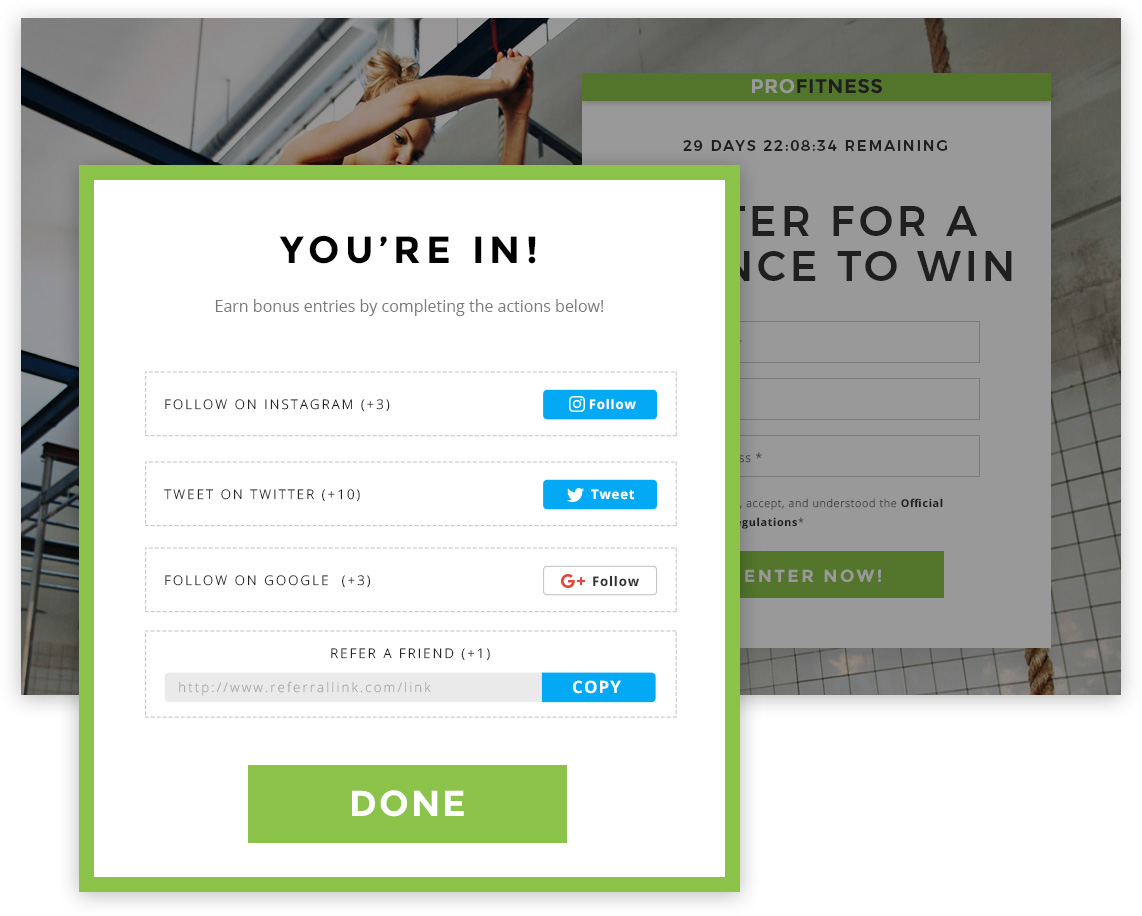

Bonuses for registration and deposits

Many modern casino welcome bonuses typically come as a combination between percentage-based deposit matches and free spins. This means that new users will enjoy not only a cash bonus matched with first deposit (or first few deposits depending on the package), but also a number of free spins on selected slots. To be remembered however that each of these may have different turnover requirements, so check the bonus details table presenting all these terms on each individual casino offer page.

The match deposit bonus is one segment of a welcome package. It is exclusive to new players and typically doubles their deposit amount. For instance, if a casino has a bonus offer of 100% up to $100, players making a deposit of $100 will receive an additional $100 in bonus cash.

The accounts that give you the most money for signing up are investment brokerages or banks (via credit cards or savings accounts). However, they typically have strict requirements for earning a bonus. For example, Moomoo currently offers up to 16 free stocks for opening an account and depositing $1,000. Similarly, large brokerage account deposit bonuses can be found on platforms like TradeStation, which offers a $150 bonus for making a $500 investment.

Many modern casino welcome bonuses typically come as a combination between percentage-based deposit matches and free spins. This means that new users will enjoy not only a cash bonus matched with first deposit (or first few deposits depending on the package), but also a number of free spins on selected slots. To be remembered however that each of these may have different turnover requirements, so check the bonus details table presenting all these terms on each individual casino offer page.

The match deposit bonus is one segment of a welcome package. It is exclusive to new players and typically doubles their deposit amount. For instance, if a casino has a bonus offer of 100% up to $100, players making a deposit of $100 will receive an additional $100 in bonus cash.

Support for popular payment systems

CloudPayments is a Russian payment system aimed at businesses operating both in the domestic and international markets. Supported payment methods include cards of Russian and foreign banks, as well as integration with local payment services such as Tinkoff Pay, Fast Payment System (FPS), SberPay, and Russian digital wallets (Yandex.Money, Mir Pay). CloudPayments provides flexible tools for business, including online cash registers, installments and subscriptions, which allows you to adapt the service to the specifics of the company and its audience.

De vraag naar oplossingen die bedrijven kunnen helpen met internationale betalingen neemt toe en de waarde van grensoverschrijdende e-commerce zal in 2028 naar verwachting meer dan $ 3,3 biljoen bedragen. Hieronder leggen we uit wat de verschillende soorten wereldwijde betaaloplossingen zijn, hoe je het juiste platform voor je bedrijf kiest en hoe je veelvoorkomende uitdagingen bij wereldwijde betalingen kunt overwinnen.

Ze geven je bruikbare inzichten op wereldwijde schaal: Deze systemen leveren waardevolle informatie over je klanten: waar ze vandaan komen, hoe ze het liefst betalen en wat de verkoopcijfers stimuleren. Dit inzicht helpt je je strategie te verfijnen, je marketinginspanningen aan te passen en slimmere beslissingen te nemen over waar je vervolgens in gaat investeren.

CloudPayments is a Russian payment system aimed at businesses operating both in the domestic and international markets. Supported payment methods include cards of Russian and foreign banks, as well as integration with local payment services such as Tinkoff Pay, Fast Payment System (FPS), SberPay, and Russian digital wallets (Yandex.Money, Mir Pay). CloudPayments provides flexible tools for business, including online cash registers, installments and subscriptions, which allows you to adapt the service to the specifics of the company and its audience.

De vraag naar oplossingen die bedrijven kunnen helpen met internationale betalingen neemt toe en de waarde van grensoverschrijdende e-commerce zal in 2028 naar verwachting meer dan $ 3,3 biljoen bedragen. Hieronder leggen we uit wat de verschillende soorten wereldwijde betaaloplossingen zijn, hoe je het juiste platform voor je bedrijf kiest en hoe je veelvoorkomende uitdagingen bij wereldwijde betalingen kunt overwinnen.

Ze geven je bruikbare inzichten op wereldwijde schaal: Deze systemen leveren waardevolle informatie over je klanten: waar ze vandaan komen, hoe ze het liefst betalen en wat de verkoopcijfers stimuleren. Dit inzicht helpt je je strategie te verfijnen, je marketinginspanningen aan te passen en slimmere beslissingen te nemen over waar je vervolgens in gaat investeren.